This list is incomplete and will be periodically updated.

1676– Pennsylvania prohibits the use of distilling of any grain unless it was “unfit to grind and boalt.”

1791– The Excise Act was passed on March 3, 1791 to become operational on July 1st. – taxes instituted by Alexander Hamilton would instigate Western Pennsylvanians to rebel and give rise to the Whiskey Rebellion which peaked in 1794.

1795– The Pinkney Treaty with Spain allowed access to the Mississippi River.

1802– The Excise Act was repealed on June 30, 1802.

1807– Cities like Philadelphia, Baltimore, and New York approved acts of legislature requiring all spiritous liquors offered for sale to undergo inspection by a gauger before being sold. Gauged spirits would be designated and stamped as underproof, 1st proof, 2nd proof, 3rd proof, or 4th proof.

1814 – 1817– January 1, 1814 saw another period of excise taxes instituted to pay for the War of 1812. It lasted until 1817. Unlike the first excise tax act, a tax on boilers was added. Those taxes were double the rates of still capacity for distilleries using steam heat.

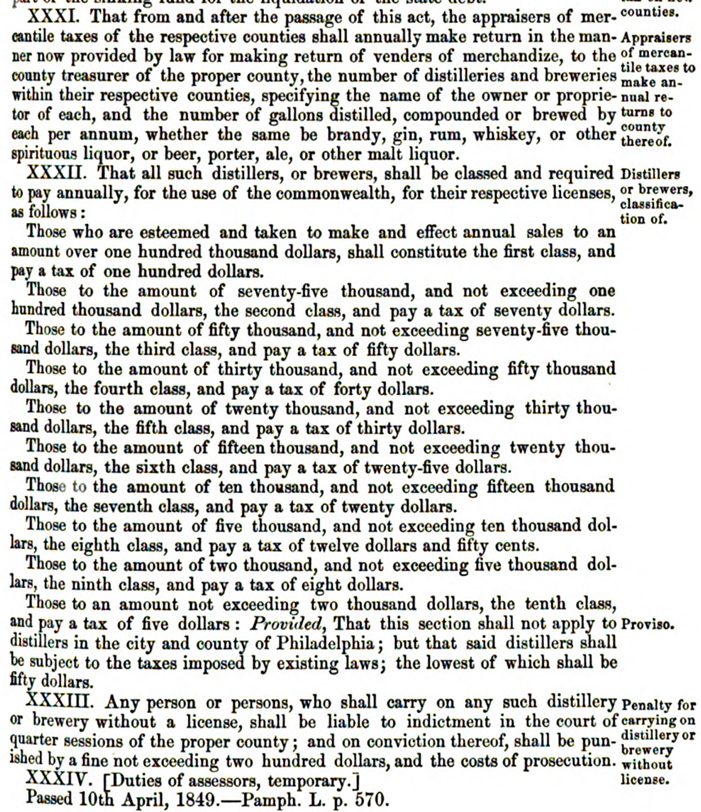

1849– Pennsylvania Acts of Assembly. Brewers and distillers must pay annual license fees that correspond to their annual sales.

1854– Law “to protect domestic and private rights and prevent abuse in the sale and use of intoxicating drinks.” Distillers and wholesalers in Pennsylvania are barred from selling to intemperate people. The courts are given the ability to revoke licenses if the licensee is found to be in violation of this law.

1856– Pennsylvania’s license system is founded, committing the granting of licenses to each manufacturer’s respective county (with the exception of Philadelphia and Allegheny Counties which established their own unique systems)

1862– July 1, 1862, Congress creates the office for the Commissioner of Internal Revenue and appoints its first commissioner.

-Pennsylvania Liquor laws regulate A. the sale of liquor, B. liquor licenses, and C. the penalties/fines associated with any violations.

July 1862- excise tax on distilled spirits was fixed at 20 cents per gallon

1864– March 7, 1864- tax raised by 40 cents to 60 cents per gallon. Spirits distilled prior to March 8th are not subjected to the 60 cent tax

March 21, 1864- After March 21, the amount allowed for leakage shall not exceed one percent. For distances not exceeding 100 miles from the distillery, 1.5 %. For between 100-200 miles, 2.5%. For distances of 500 miles or more, 3.5%.

June 1864- raised again by 90 cents to $1.50 per gallon (to take effect after July 16, 1864)

1865– February 1, 1865- an additional 40 cents was tacked on, bringing to the tax to $1.90 per gallon

Act of July 13, 1865- A $2.00 tax is levied on every proof gallon of distilled spirits.

– An inspector is assigned to each distillery (except in the case of brandy distilleries) and that inspector is barred from “becoming directly or indirectly interested I the production of spirit.” If they are connected to any distillery, they must divest themselves within 60 days of August 1, 1866 or face penalties.

1867– Act of March 2, 1867, Section 15- Distilleries are required to apply for, purchase, and install meters invented by Isaac P. Tice of New York. These meters would be used by the government officers assigned by the office of Internal Revenue to “ascertain the strength and quantity of spirits subject to tax.” The cost of the instrument would “not be more than $600 for each pair of the smallest capacity, and $800, $1000, $1200 for pairs of the other three sizes respectively.” Minute details about the distillery and measurements of all its parts/apparatuses must be included in the application.

-March 1867- Distilled spirits may not be sold at retail on distillery premises. Wholesale sales by distilleries may not be in quantities less than one gallon.

-An official manual for gaugers and inspectors is published by the US Treasury Department.

1868– July 20, 1868- An “Act Imposing Taxes on Distilled Spirits and Tobacco, and for Other Purposes” went into effect. It was composed of 109 sections of law, 59 of which covered the government’s management of distilled spirits and their taxation.

– The bonding period is limited to one year.

– The excise tax on distilled spirits is reduced from $2.00 to 50 cents per gallon.

1869– April 10, 1869- “Every person who sells or offers for sale foreign or domestic distilled spirits, wines or malt liquors, in quantities of not less than 5 gallons at the same time, shall be regarded as a wholesale liquor dealer.” Wholesale liquor dealers are expected to pay a special tax. Distillers selling spirits of heir own production, must do so in their capacity as “wholesale liquor dealers” are exempt from paying the special tax provided the sale is made within the period for which they they have paid their special tax as “distillers.” This, basically, differentiates the two distinct licenses.

1872– Stamps are no longer available to rectifiers by request. New regulations limit the number of stamps to number of proof gallons purchased for rectification. This gives gaugers similar control over rectifiers to that of distillers. When rectifier receives spirits from the distiller, he is now obligated to report to the collector the number of packages, name of the distiller that were purchased from, serial number, taxes paid, stamp date and when tax was paid, district from which received, and number of proof gallons purchased. The gauger then must inspect and then regauge spirits if redistilled and reissue new stamps for redistilled spirits.

1875– Tax on liquor brought to $1 per proof gallon. Duties on foreign sprits raised from $2 to $2.50 per gallon.

1878– Females must not be employed by distilleries.

1879– Allowances are given for leakage or casualty of spirits withdrawn from distillery warehouses for exportation.

1881– It is illegal for minors to misrepresent their age or for anyone to misrepresent a minor’s age to obtain liquor

1884– Each county’s mercantile appraisers are required to report every brewery and distillery in their counties and the amount manufactured by each. Called the “Britton Law” due to William Britton selling his manufactured goods wholesale across county borders, the state was forced to recognize that distillers could legally sell their products as long as they were licensed and paid the appropriate taxes due.

1887– The Brooks High License Law. Passed on May 13, 1887, this law regulated the retail sale of “spiritous, vinous, malt and brewed liquors.” Retail sales of alcohol in any room, house, tavern, etc. must be licensed. Pharmacies did not require licenses but did require prescriptions for alcohol. Before this law, the wholesale and retail market were both determined by the discretion of local courts.

1889– Distilleries are prohibited from refilling casks or packages previously used at the same distillery.

1890– Sherman Anti-Trust Law

1891– The Wholesale Act was passed on June 9, 1891. The Brooks Law did not go far enough to cover wholesale sale of liquor so this act was put in place. Consumption of alcohol on the premises of wholesale sales was prohibited. Wholesale sales are limited to packages larger than one quart.

1893– A second type of wholesale license is created- one for dealers who are restricted from selling anything other than original packages less than 40 gallons. A distiller can apply for an “1891” or “1893” license but not both.

1894– The “Carlisle Law” extended the bonding period for aging whiskey from 4 to 8 years with a scheduled regauge of every barrel at 7-years-old to assess its losses (a maximum allowance of 13.5 gallons of loss were deducted before taxes were assessed on each 48-50 gallon barrel)

1897– Bottled in Bond Act.

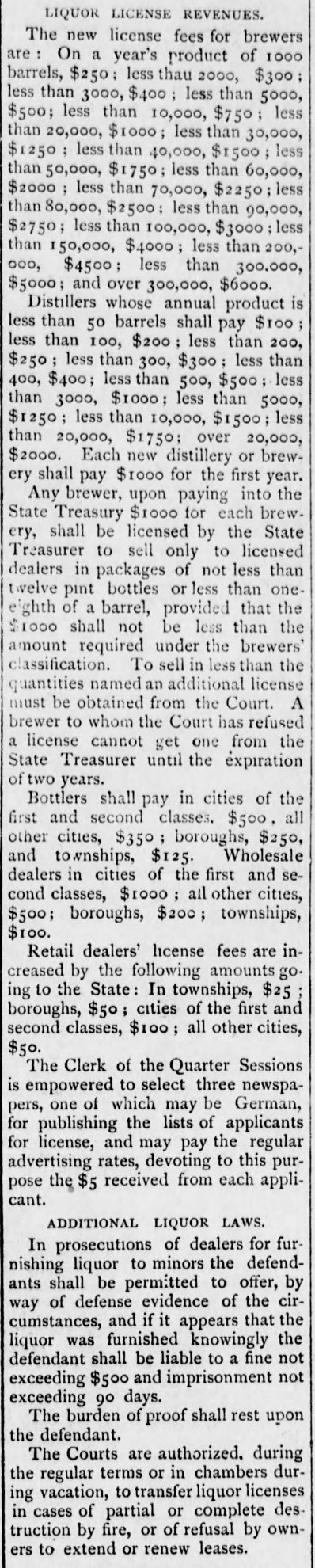

- June 21, 1897- License fees based on output. Distillers may only sell wholesale to licensed retail buyers. (see image below)

1906– Put into effect on January 1, 1907- Industrial and farm distilleries are given freedom to distill alcohol, free from taxation, with the understanding that it be denatured and unpotable.

-The Pure Food and Drug Act. While this act did not mention whiskey, it dealt with truth in labeling which would certainly affect the industry.

1907– Roosevelt-Bonaparte-Wiley Decision

1909– Taft Decision- “What is whiskey?” Taft explains that rectified and straight whiskeys are both “whiskeys,” but must be labeled as such.

1910– First legal guidelines resulting from the Taft Decision are implemented by the Treasury Department in April 1910. New guidelines are established for gauger’s marks/brands/stamps on barrels. Labeling designations included “whiskey,” “high wines,” “cologne spirits,” “alcohol,” or “neutral grain spirits.”

1911– Kline License Bill. Power of the local court judges to allow licenses to be given to distillers is passed to the Treasury Department. The Kline License Bill repeals the 1897 bill restricting sales to only licensed buyers. Distillers may now sell to anyone and accept orders at their distillery to deliver anywhere. If an applicant was refused by the courts, he may reapply to the Treasury Department.

1916– (not exactly legal, but important in its significance for legal decision making) The authors of The Pharmacopeia of the United States of America– a reference book of standards, identities, and formulas for drugs/medicines- took two liquors, brandy and whiskey, off the list of scientifically approved medicines. (The American Medical Association also voted to advocate for prohibition in 1917.)

1917– The Lever Act, otherwise known as the Food and Fuel Act (or its longer name- “An Act to provide further for the national security and defense by encouraging the production, conserving the supply, and controlling the distribution of food products and fuel”) is passed by Congress. The Food and Fuel Act prohibits distilleries across the country from processing grain into liquor.

1918– Congress approves the 18th Amendment and sends it to the states for ratification.

1919– The 18th amendment was ratified on January 16, 1919 when Nebraska became the 36th state in the union to sign on with their approval.

-The Volstead Act is drawn up.

1920– The Volstead Act goes into effect.

1921– The Willis-Campbell Act was passed to refine and tighten the restrictions imposed by the Volstead Act.

1922– The Concentration Act is passed effectively ordering the contents of America’s bonded warehouses to be consolidated into a couple dozen warehouses hand-picked by the Secretary of the Treasury and the Commissioner of Prohibition.

1923– April 1, 1923 – The US Prohibition Commissioner and Andrew Mellon, the country’s new Treasury Secretary, approved a law to force all prescriptions to meet the legal criteria for bottled-in-bond.

1925– (not exactly legal, but important in its significance for legal decision making) Whiskey returns to The Pharmacopeia of the United States of America– a reference book of standards, identities, and formulas for drugs/medicines.

1927– April 1, 1927, the Prohibition Bureau, which had been under the auspices of the Department of Internal Revenue and led by the Commissioner of Prohibition and the Secretary of the Treasury, became an independent entity within the Department of the Treasury. The Secretary of the Treasury, which had been Andrew Mellon since 1921, would now oversee the entire department.

– The Treasury Department began to determine which warehousemen and distillery owners would be given the task of distilling medicinal whiskey to fulfill the Willis Campbell Act’s call to maintain medicinal whiskey reserves.

1932– In December 1932, a Resolution to Repeal the 18th amendment with the 21st amendment was approved by Congress.

1933– March 21, 1933 Congress passed the Cullen- Harrison Act and it was signed by President Franklin D. Roosevelt the following day. “The Cullen Act,” as it was called, legalized the sale of beer with an alcohol content of 3.2% (by weight) and wine of similarly low alcohol content.

– On December 5, 1933, the ratification of the 21st amendment repealed the 18th amendment and brought an end to Prohibition.

1935– Federal Alcohol Administration Act establishes standards of identity for alcohol. Straight whiskey becomes a legal term/designation but has several descriptions. Straight whiskey does not definitively become 2 years old until 1938.

While many new laws followed almost immediately, I have chosen to end the legal listings here. This list will continue to be updated, but this list deals only with pre-Prohibition and Prohibition laws. I may decide to change that in the years to come, but this list is to show how laws shaped the post-Prohibition liquor landscape.